Where Prices are Now

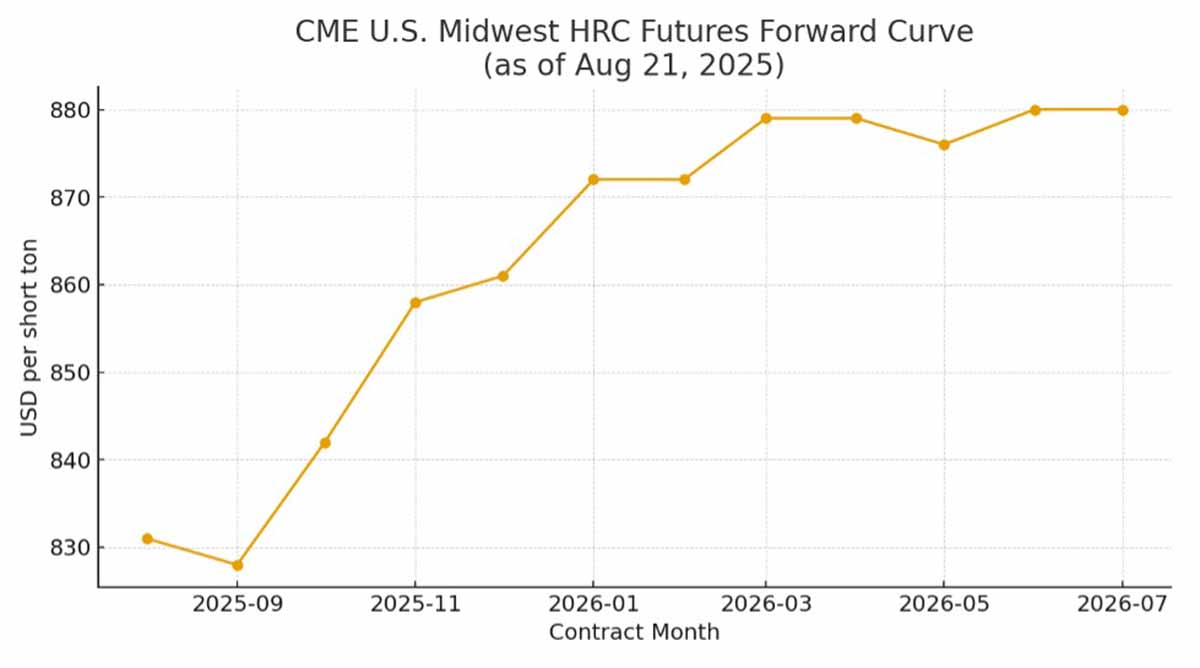

- Spot / futures snapshot: Nearby CME U.S. Midwest HRC contracts are printing in the low $800s; Aug ’25 ~$832, Sep ’25 ~$816, Oct ’25 ~$826 (CME quotes page).

- Spot check (today): ≈ $804/t.

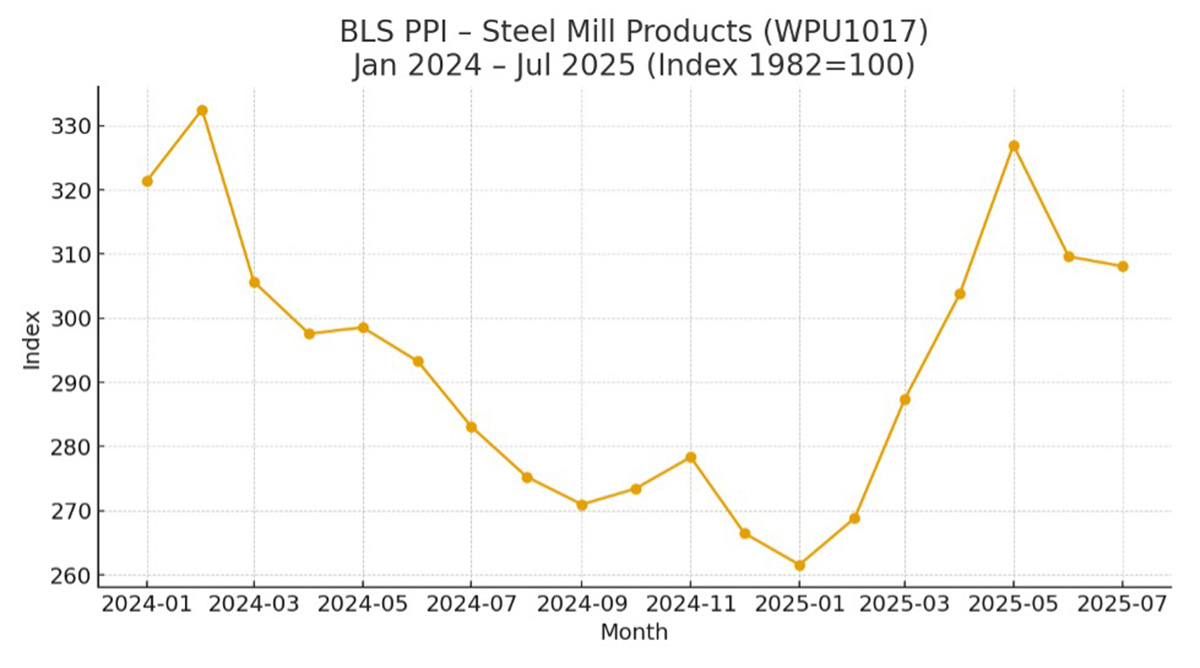

- Index backdrop: BLS PPI – Steel Mill Products (WPU1017): 308.1 (Jul ’25).